GenAI Solutions Help European AI Market Thrive in an Uncertain Economic Environment, Says IDC

- Inno-Thought Team

- Sep 19, 2023

- 4 min read

AI solutions are becoming increasingly widespread, driven by operational efficiency and IT optimization needs, as well as to provide improved customer experiences. IDC indentified augmented threat intelligence and prevention systems, together with augmented fraud analysis and investigation, as prevalent AI use cases, particularly in the finance sector and in more threat-exposed industries such as telecom or central and local government.

The latest Worldwide Artificial Intelligence Spending Guide (V2 2023) published by International Data Corporation (IDC) shows that artificial intelligence (AI) spending in Europe will reach $34.2 billion in 2023, representing 20.6% of the worldwide AI market. AI spending in Europe will post a 29.6% compound annual growth rate (CAGR) between 2022 and 2027, slightly higher than the worldwide CAGR of 26.9% for the same period, with spending expected to exceed $96.1 billion in 2027.

AI solutions are becoming increasingly widespread, driven by operational efficiency and IT optimization needs, as well as to provide improved customer experiences. IDC indentified augmented threat intelligence and prevention systems, together with augmented fraud analysis and investigation, as prevalent AI use cases, particularly in the finance sector and in more threat-exposed industries such as telecom or central and local government. Improved customer experience and enhanced sales processes are delivered through use cases such as augmented customer service agents and sales process recommendation and augmentation, primarily in the retail space and, to a lesser extent, in banking.

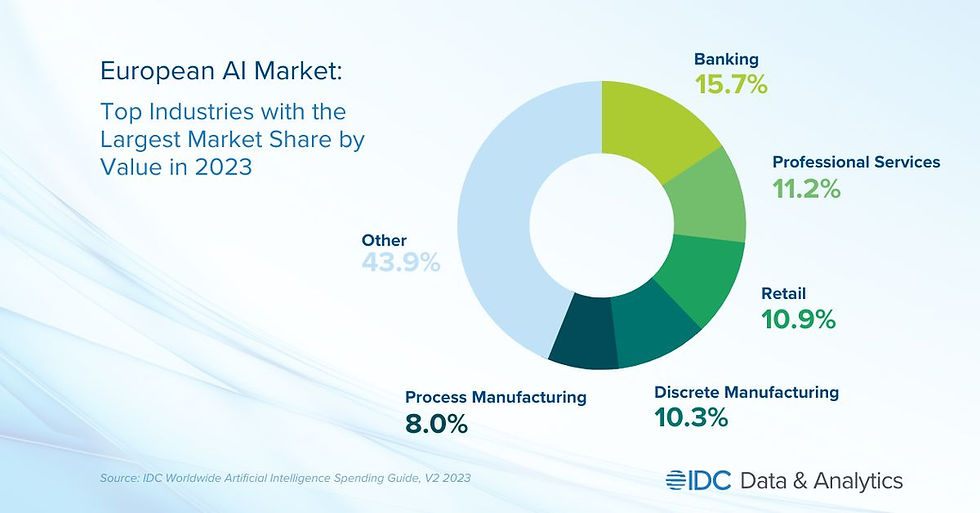

Banking, professional services, retail, manufacturing, and telecom are the biggest AI industries, accounting for more than 60% of total European AI market spending in 2023. While spending in other industries such as healthcare, media, personal and consumer services, and utilities is smaller, it is growing at a higher-than-average pace.

In an uncertain economic environment, where inflation is playing a key role in investment decisions, the AI market is still growing healthily, supported by demand for generative AI (GenAI) technologies.

"GenAI is gaining attention from vendors, consumers, and businesses, raising questions that range from how to embed the technology in products and how to benefit most from its usage to how to ensure responsible usage, given such widespread demand," says Carla La Croce, research manager for Customer Insights and Analysis, IDC.

GenAI uses cases are exploding. IDC’s Spending Guide shows that the fastest-growing GenAI use case is image creation, which is widely used in media and marketing activities, followed by text creation, particularly in the professional services industry.

“Spending on GenAI use cases is still lower than for more well-established AI use cases, but it is growing rapidly. The creation of images, text, and videos are the most common use cases, with the greatest growth over the last year,” says La Croce. “Companies are racing to enhance existing applications with AI features, while more forward-looking and innovative vendors are embedding GenAI in their solutions to meet increasing demand.”

About The Worldwide Artificial Intelligence Spending Guide

The Worldwide Artificial Intelligence Spending Guide examines the artificial intelligence (AI) systems opportunity from the use case, technology, industry, and geography perspectives. This comprehensive database, delivered via IDC Customer Insights Query Tool, allows the user to easily extract meaningful information about the AI technology market by viewing data trends and relationships and making data comparisons.

Markets and Technologies Covered

3 technology groups with 8 technology categories comprising 10 technologies: Hardware (server and storage), software (AI applications, AI application development and deployment, AI platforms [AI life cycle, AI software services, and intelligent knowledge discovery software], AI system infrastructure software), and services (business services and IT services)

2 deployment types for software: On premises/other and public cloud services

36 use cases: Automated customer service agents, automated threat intelligence and prevention systems, digital assistants, fraud analysis and investigation, program advisors and recommendation systems, supply and logistics, and more

19 industries: Banking, insurance, securities and investment services, discrete manufacturing, process manufacturing, construction, resource industries, retail, wholesale, professional services, personal and consumer services, transportation, healthcare provider, federal/central government, state/local government, education, telecommunications, media, and utilities

Geographic Coverage

9 regions: United States, Canada, Japan, Western Europe, Central and Eastern Europe, the Middle East and Africa, Latin America, PRC, and Asia/Pacific

32 countries: Argentina, Australia, Brazil, Canada, Chile, Colombia, France, Germany, Hong Kong, India, Israel, Italy, Japan, Korea, Mexico, Peru, PRC, rest of Asia/Pacific, rest of Central and Eastern Europe, rest of Latin America, rest of the Middle East, rest of Africa, rest of Western Europe, Russia, Saudi Arabia, Singapore, South Africa, Spain, Turkey, United Arab Emirates, United Kingdom, and United States.

Data Deliverables

This spending guide is delivered on a semiannual basis via a web-based interface for online querying and downloads. For a complete delivery schedule, please contact an IDC sales representative. The following are the deliverables for this spending guide:

Annual five-year forecasts by use case, industry, and technology — delivered twice a year

Key Questions Answered

The research addresses the following issues that are critical to your success:

Where should I focus my resources for the greatest return on investment?

Which technologies will grow the fastest in AI spending?

Which regions and countries are early adopters of artificial intelligence technology?

Which industries show the greatest long-term potential, and which are the largest industries in any specific country for AI spending?

In which use cases should you develop expertise to support your AI business?

What does the future hold for the adoption of AI? Which areas should I develop, and which should I avoid?

IDC's Worldwide Artificial Intelligence Spending Guide (V2 2023) sizes spending for technologies that analyze, organize, access, and provide advisory services based on a range of unstructured information. It quantifies the AI opportunity by providing data for 36 use cases across 19 industries in nine regions and 32 countries. Data is also available for the related hardware, software, and services categories.

Comments