Hang Seng Digital Business Banking Services To Help Enterprises Seize Opportunities In The Rebound

- Inno-Thought Team

- Jul 14, 2022

- 3 min read

Hang Seng Optimises Digital Business Banking Services To Help Enterprises Seize Opportunities In The Economic Rebound

Hang Seng Bank offers diversified commercial banking service solutions to meet the needs of Small and Medium Enterprises (SMEs) at different stages in Hong Kong. The global business environment changes rapidly under fluctuating pandemic situation and Hang Seng has been optimising digital business banking services to allow enterprises to maintain efficiency in a competitive market, while focusing on their business expansion. Hang Seng Commercial Banking introduced over 250 digital innovations and enhancements in the previous year. The number of customers using digital banking services has increased significantly by around 120%, while digital channel transactions have seen a double-digit growth.

Mr Donald Lam, Head of Commercial Banking of Hang Seng Bank said that as digitalisation is gaining popularity among SMEs, Hang Seng has stepped up its Digital Business Banking services to help customers handle their financial matters from anywhere at any time.

As part of Hang Seng Commercial Banking's ongoing customer-centric initiatives, it has expanded its Remote Account Opening Service and launched online loan application platform with an e-Sign function. The enhanced service also supports companies that have a maximum of five 'connected parties', which frees customers from the need to visit a branch to carry out in-person signing to complete the account and loan application, enabling a truly online journey for both services which are essential to businessmen.

Mr Donald Lam, Head of Commercial Banking of Hang Seng Bank, said, "As digitalisation is gaining popularity among SMEs, Hang Seng has stepped up its digital business banking services for customers to better utilize their funds and resources and handle their business needs from anywhere at any time. To further promote digital business banking services and help customers expand their business, we have launched a series of limited time offers on digital business banking services and invited Mr Sham Kaki, a rising local actor, to perform humorous video pitches to bring the services to life. By leveraging Kaki's young image and his personal entrepreneurial experience, the promotions hope to resonate with SMEs and show that Hang Seng has been striving to uplift their banking experience and wishes to enhance their efficiency to seize opportunities brought by the economic recovery."

Mr Sham Kaki is one of Hang Seng Bank's commercial customers. In the series of advertising specials, he acts to mimic a businessmen's life in encountering various challenges when doing business. The videos also cover the four major pain points of the financial management of SMEs, including methods to collect payment and track remittance seamlessly, using cheque deposit services and managing the operating expenses. For details, please visit youtube.com/HangSengCommercialBanking.

Mr Sham Kaki said, "As a SME owner, we have to carry out everything ourselves and deal with all sort of matters. Therefore, an all-rounded e-Banking service really helps us a lot! Other than making payment easier, we can also check the remittances status instantly in real time manner, also, the seamless collection services help a lot in reducing the number of drop off rate across platforms and simplifies the procedures. I can now focus more on the development of performing arts and my company business at the same time."

In addition to digital enhancement, Hang Seng combines innovation with human touch to provide customers with comprehensive and personalised banking service support through online and offline channels. Hang Seng offers a 24-hour service hotline and Live Chat for support. Online webinars are also held regularly to enhance customers' experience of using "e- Banking" services, in which customers are able to enjoy both digital and the physical banking services.

Hang Seng's diversified digital solutions, helping Commercial Banking customers to have their business LEVEL UP

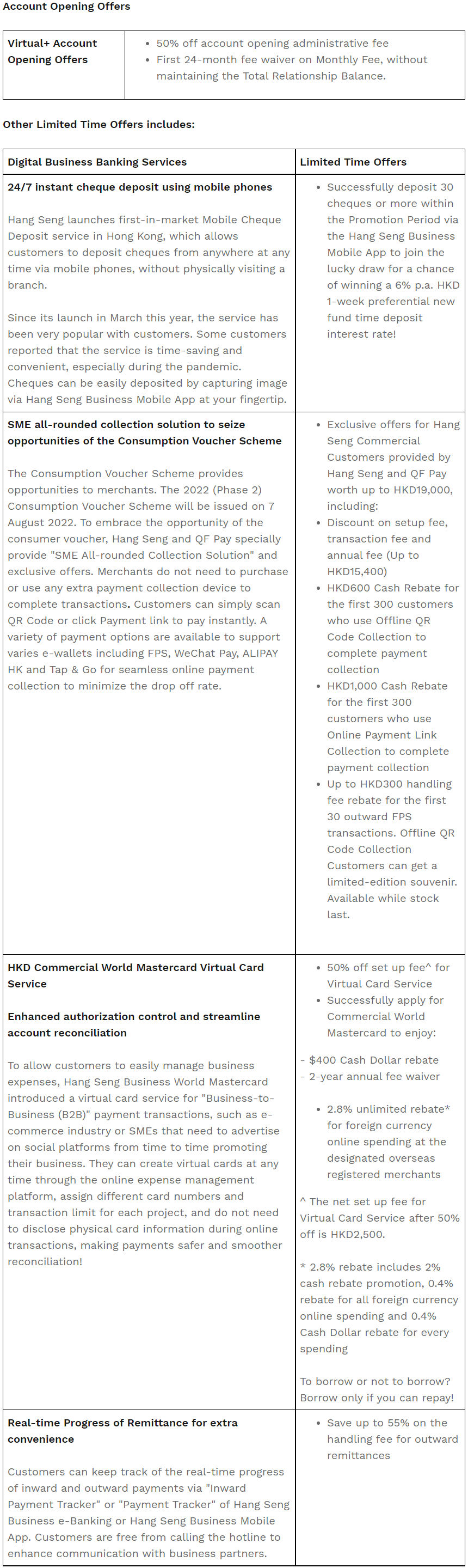

From 13 July 2022 until 30 September 2022, Hang Seng launches a series of limited time offers on digital business banking services. Online transactions may save up to 55% in handling fees, and the offers are valued up to HKD36,888, assisting SMEs expand their business. Limited time offers include:

Comments